Rates and Annual percentage rate: Although the interest rate and you will Annual percentage rate confidence various products, there’s an average rate a variety of credit programs. With a decent credit history, the pace vary anywhere between fifteen% so you’re able to twenty-five%. Apr exceeds interest levels; for a financial loan that have a good fifteen% fee, this new Annual percentage rate might go of up to 400%.

Informative resources: MoneyMutual has lots of educational info, which include faq’s, financing charges and you will cost, payday loan recommendations, cash advance info, and you can a less than perfect credit financing book. This type of info improve individuals build an informed decision.

Professionals

- Mortgage recognition in minutes

- Finance is easily placed into the borrower’s accounts

- No charge for making use of the financing platform

- Easy and quick entry to a large circle away from lenders

- User-amicable platform

- Ideal for bad credit financing

Cons

- Unavailable in every U.S. states

- Zero upfront information regarding rates

BadCreditLoans was a 100% free lending system which provides higher-chance signature loans from the direct lenders it people with. Its financing system consists of tribal and condition loan providers. The newest tribal loan providers bring large costs and you may costs as compared to county loan providers. The official loan providers is actually condition-signed up and you can stick to the condition downs towards mortgage terminology and you will costs.

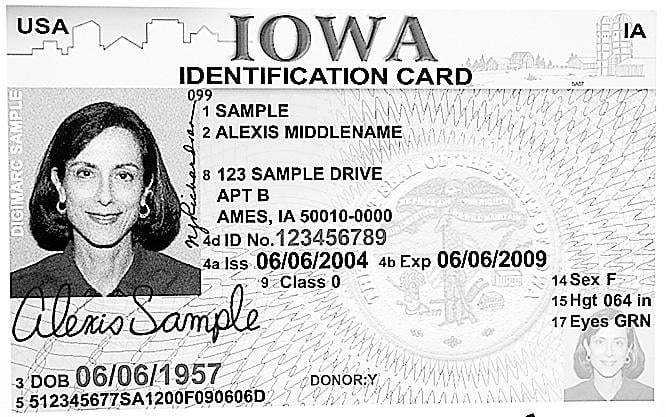

This is exactly a financing platform rather than a primary lender. It’s got 100 % free functions to your borrowers so that they link toward loan providers due to their network. To-be eligible for brand new high-exposure funds on this system, you need to be at the very least 18 years old and have now a good normal payday loans no phone calls no faxing earnings or any other version of benefit. Without having a typical earnings, it’s also possible to let you know people public defense evidence to spend the money for unsecured loan. In addition to this pointers, you need to also provide evidence of citizenship as well as have an examining account on the title.

Depending on the recommendations provided with your to the system from BadCreditLoans, you will get a particular repayment identity about direct financial. The latest loans provided by the newest head lenders as a rule have good 90 months payment term at a minimum and you may all in all, 72 weeks or half dozen age. not, not all the loan providers must offer these types of rates. For example, for folks who obtain $2000 getting a year having an annual percentage rate off 19.9% and a monthly installment from $, your own full cost was $2,.

The state webpages regarding BadCreditLoans even offers more than simply fund. Right here you might keep yourself well-informed about how the loan work and you may the latest frauds one individuals can get deal with whenever you are requesting financing online.

Highlights

Application processes: BadCreditLoans lets consumers to try to get large-risk cash advance inside the an easy step three-action processes. You ought to complete an internet function and you can wait for the system in order to connect you to definitely a direct financial. You then evaluate the choices and you will finish the mortgage techniques when the do you believe the fresh new agreement are predicated on your preferences.

Financing number: Within BadCreditLoans, you can request funds anywhere between $five hundred and $10,000. You can also examine in advance for folks who qualify for the borrowed funds or otherwise not. However, with this system, really lead loan providers give high-risk-unsecured loans otherwise payday loans, actually so you’re able to individuals having bad credit.

Interest rates and you will Apr: BadCreditLoans offer prices between 5.99% and %, but it addittionally utilizes this new direct lender you’re in package with. The newest prices may differ according to lender and your economic problem.

Offered lender system: The newest lending system works together a food cravings lender system to with ease rating a lender predicated on your needs. Although not, for many who still cannot find any financial, the working platform delivers their inquiry to help you a third-team financial system. Even when so it system isnt a direct lender, it works with assorted lenders and you can channels to help you get a lender to you personally.